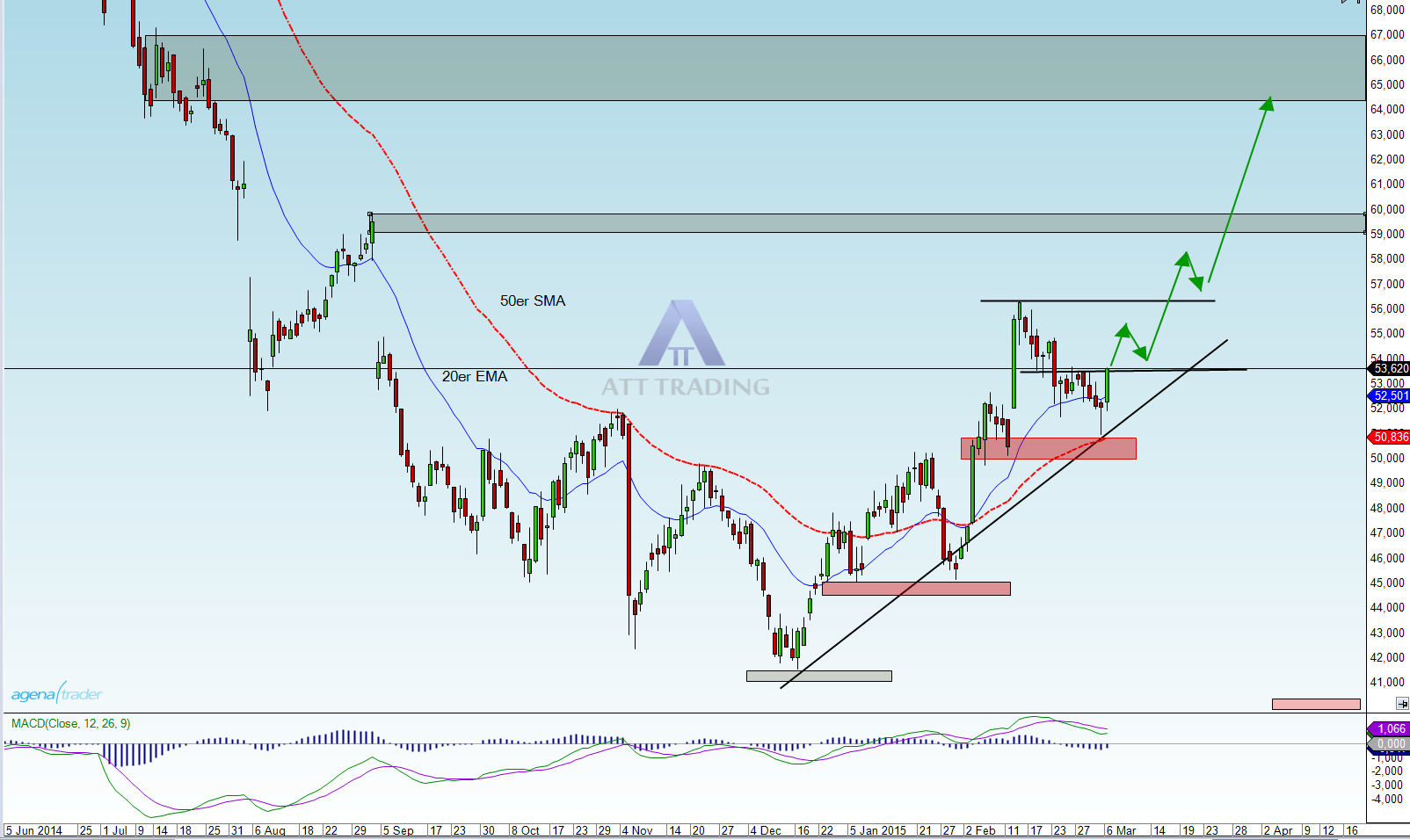

Timeframe:

short-, medium-term

Tendency:

short-term: up

medium-term: up

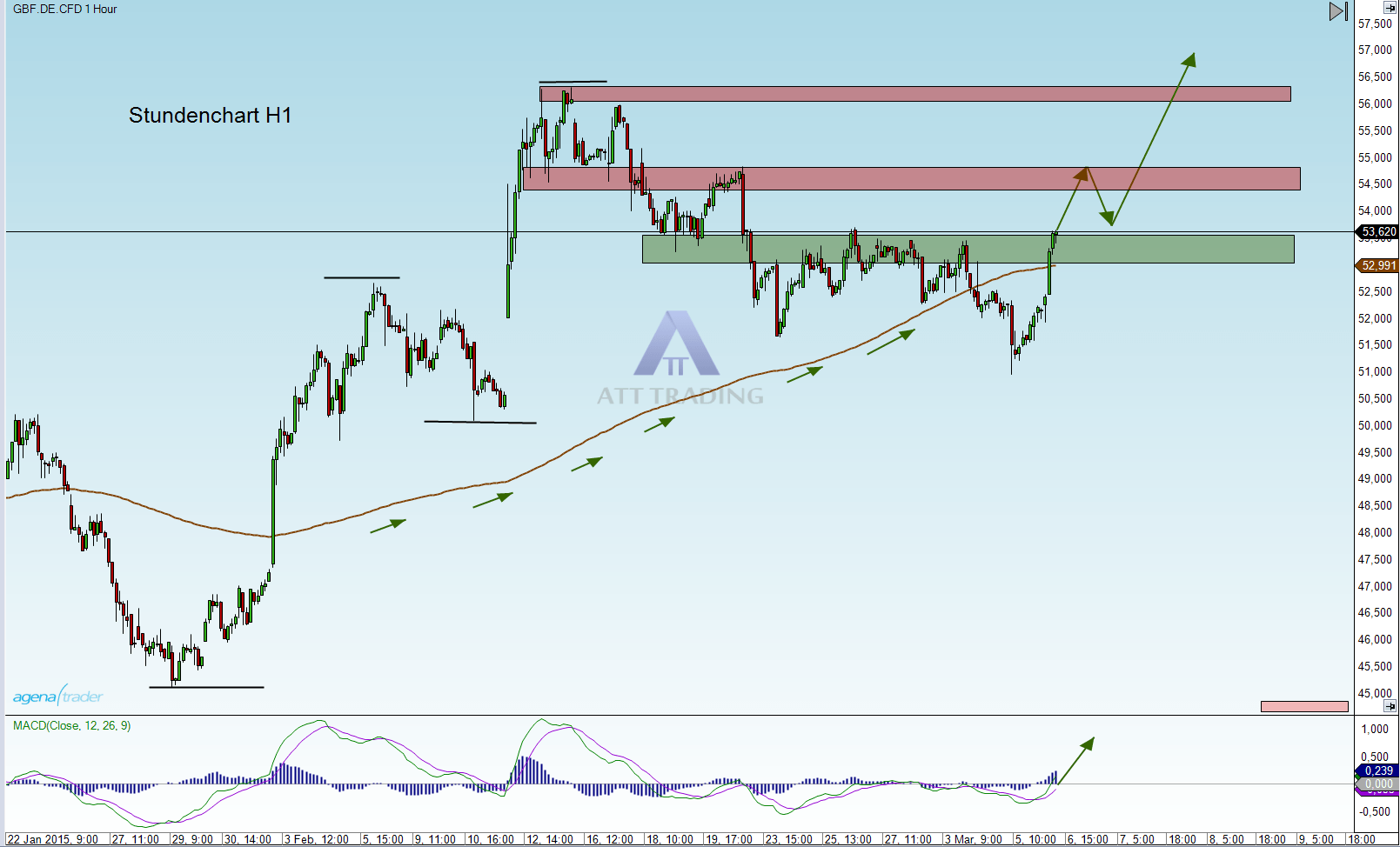

resistance zones: around 55,50 € – 55,00 €

support zones: around 52,90 € – 53,50 €

Bilfinger (GBF)

Bilfinger SE is an international corporation, which is involved in all areas of construction. The company provides services related to maintenance of industrial plants and power plants and also industrial bulding construction and activities in infrastructure. Bilfinger also develops complete solutions for building and infrastructure projects. The clients come from both the puplic and private sector. The company is also one of the leading tunnel specialist in their home country and abroad. Bilfinger has numerous subsidaries in Germany and in many other countries.

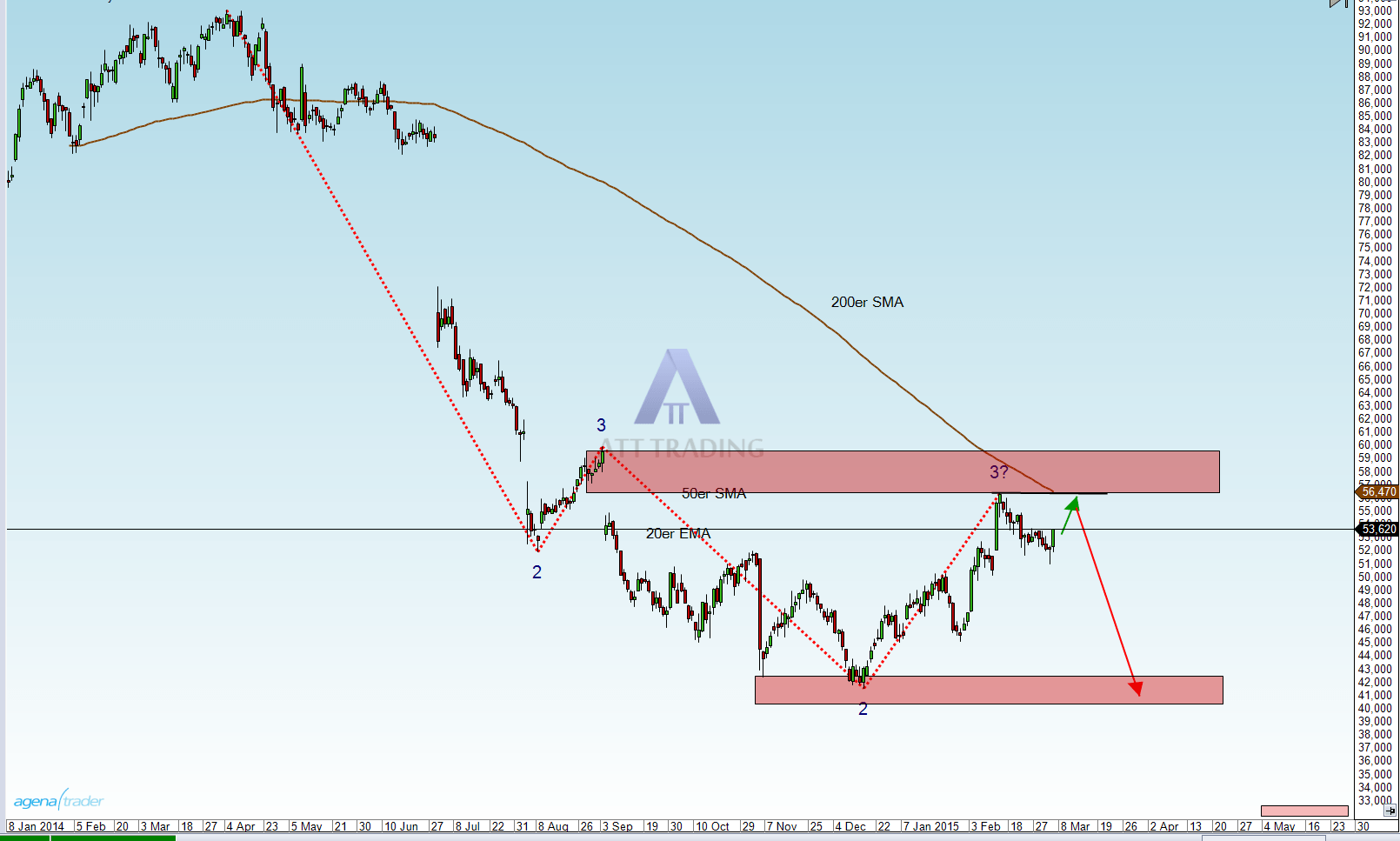

Current situation and outlook:

The construction company Bilfinger was able to find it´s bottom last year in december and since then we can cleary see raising prices. Currently the bulls seem to have taken over the command because we can see a uptrend with higher highs and higher lows. The raising price is also accompanied by rising moving averages.

Possible scenario:

If the price continues to go up this new uptrend is likely to continue. In the area of 54,50 € – 55,00 € the stock could take a short consolidation back into the current area, which could be a good possiblity to enter a long position (figure 2). If the price would directly break through the zone around 55,00 € we need to find a possible entry in this area.

Alternative scenario:

If the price would bounce off the resistance zone at 55,00 € – 56,00 € and the 200 SMA, the long scenario would be over at the moment.

In this case if would be a good idea to stay flat and observe what the stock will be doing.

Conclusion:

The Bilfinger stock could convice over the last month with raising prices. The bulls used each pullback this year to buy the stock. Righ now we are in such a pullback phase which could be used by investors again. The next target would be the area around 57,50 € – 58,00 € and we also have some more targets above.

Disclaimer: Disclosure according to § 34b WpHG due to potential conflicts of interest:

The author is invested in the relevant securities or underlying securities at the time of publication of this Analysis.