Background

Newell Rubbermaid is a company that operates in the consumer goods sector. The company works with Global Business Units, which develop world brands. Newell Rubbermaid has a wide range of products.

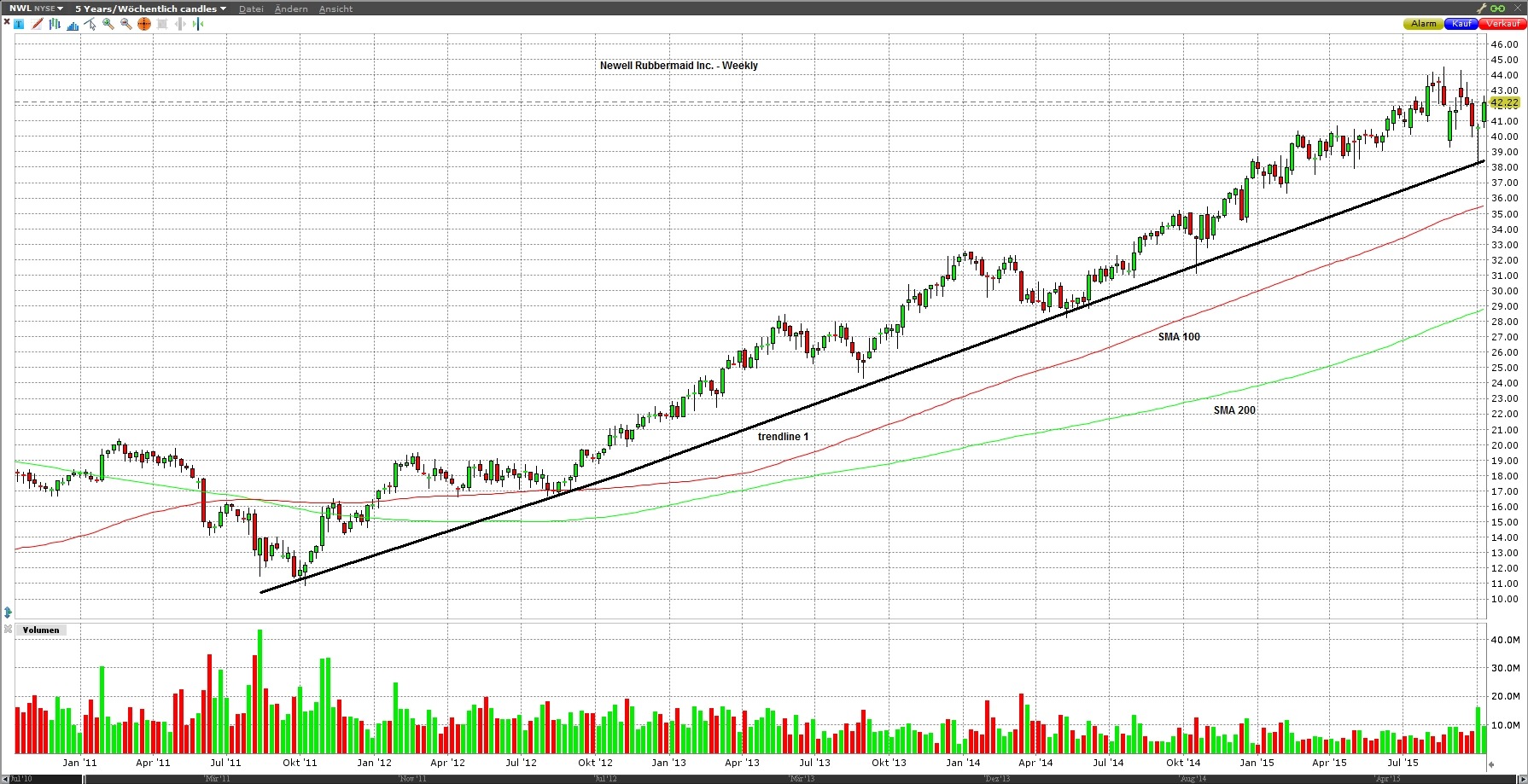

In Figure 1 we can see that the stock price has risen since 2011 from $12.00 to $44.00. The stock made a stable uptrend, but is currently in a correction. For mid-term traders this correction is a clear downtrend on the daily chart and this means we should get a good short opportunity right now. Especially while the overall market is still in a downtrend.

Management and risk description

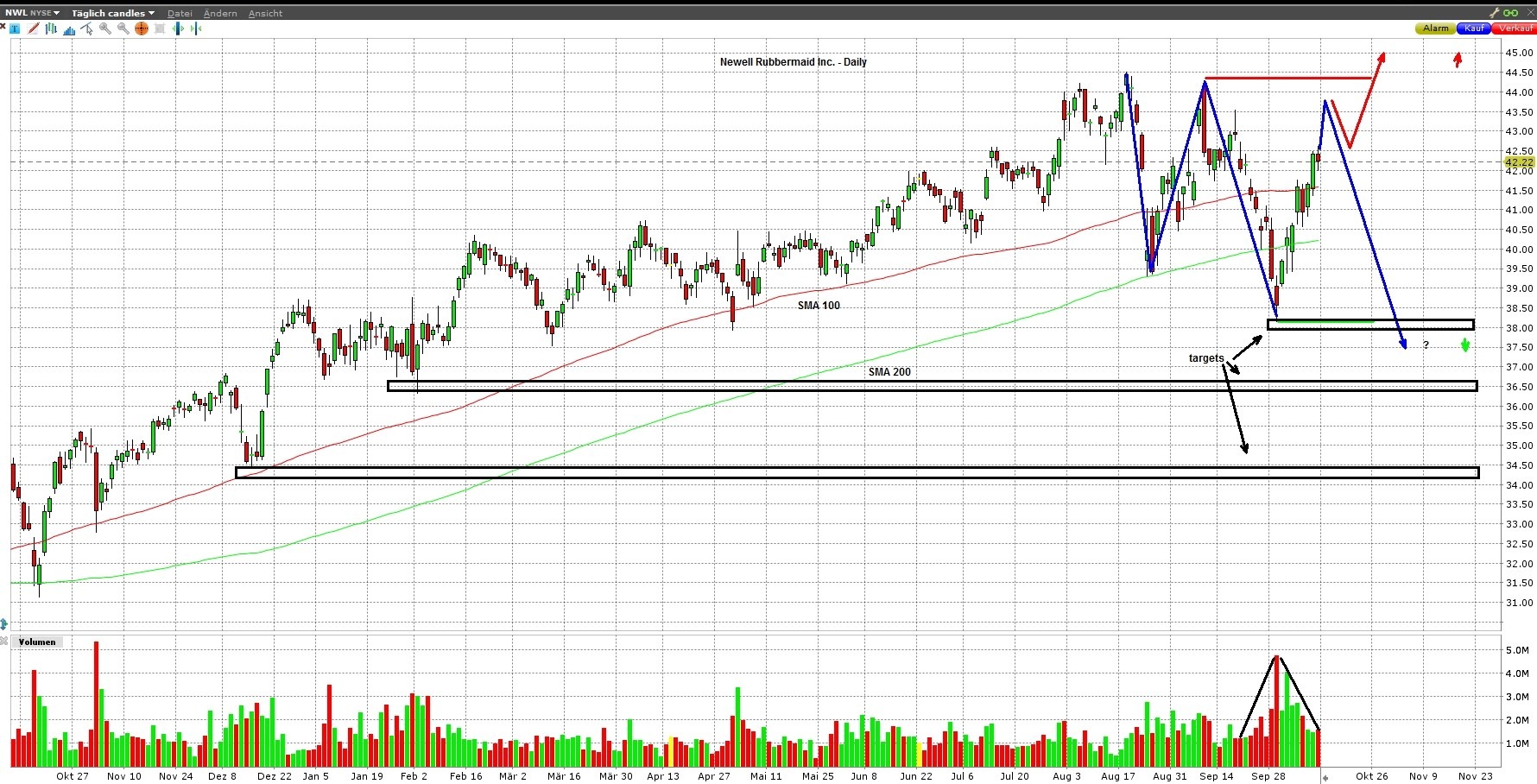

On the daily chart (Figure 2) we can clearly see that a strong downward trend has formed, which is drawn in blue. This downtrend is supported by higher volume and currently the stock made a 80% correction with decreasing volume.

Mid-term traders could wait for a subordinate downtrend for the entry in the current correction. With increasing selling pressure the targets around $38.00, $36.50 and $34.50 could be very interesting.

Above $44,50 our short idea would be over.

Parameters

Entry: $43,50

Stop: $44,50

Target: $38,00, $36,50, $34,50

Time horizon: medium-term