Timeframe:

short-, mid-term

Tendency:

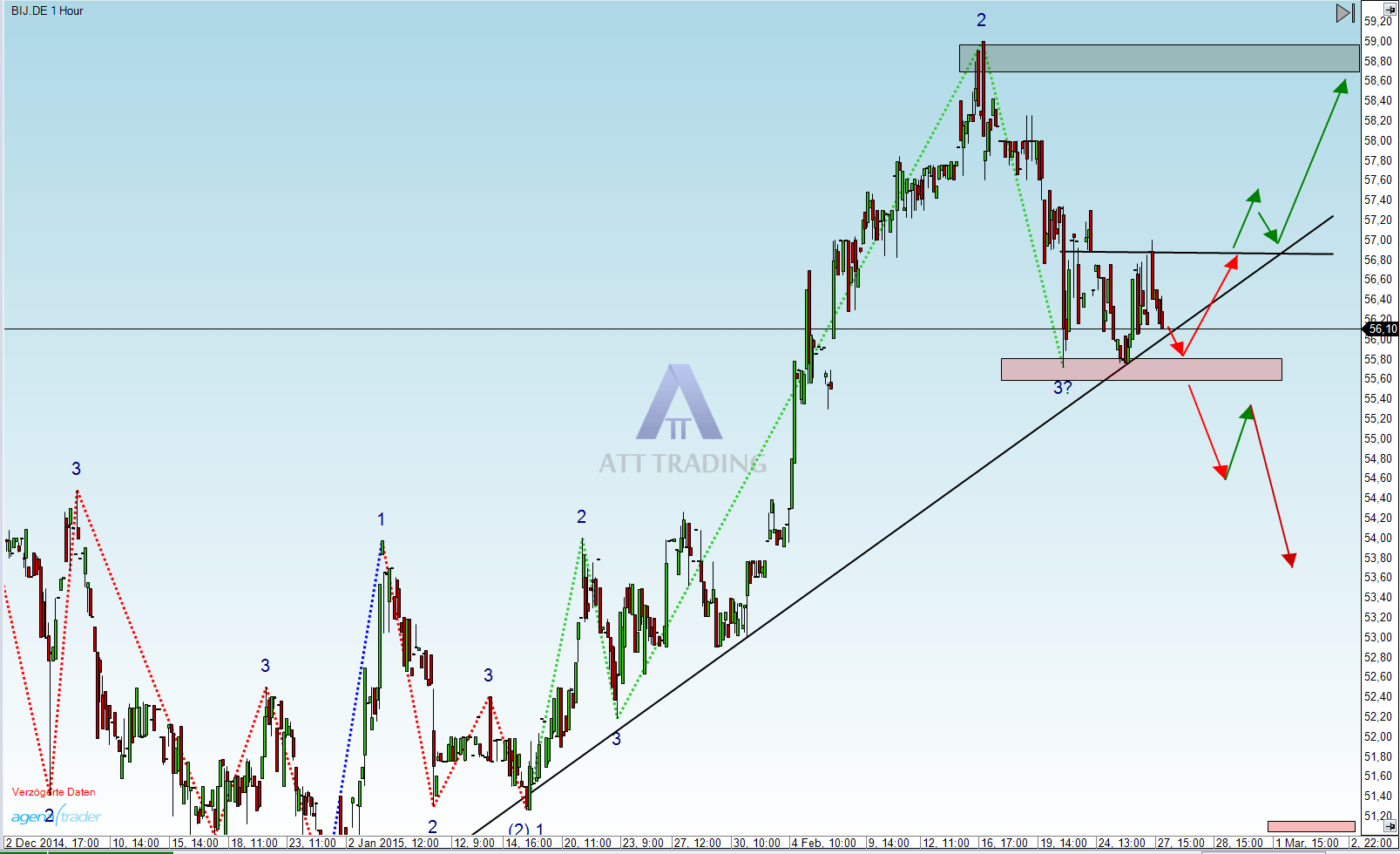

short-term: short

mid-term: short

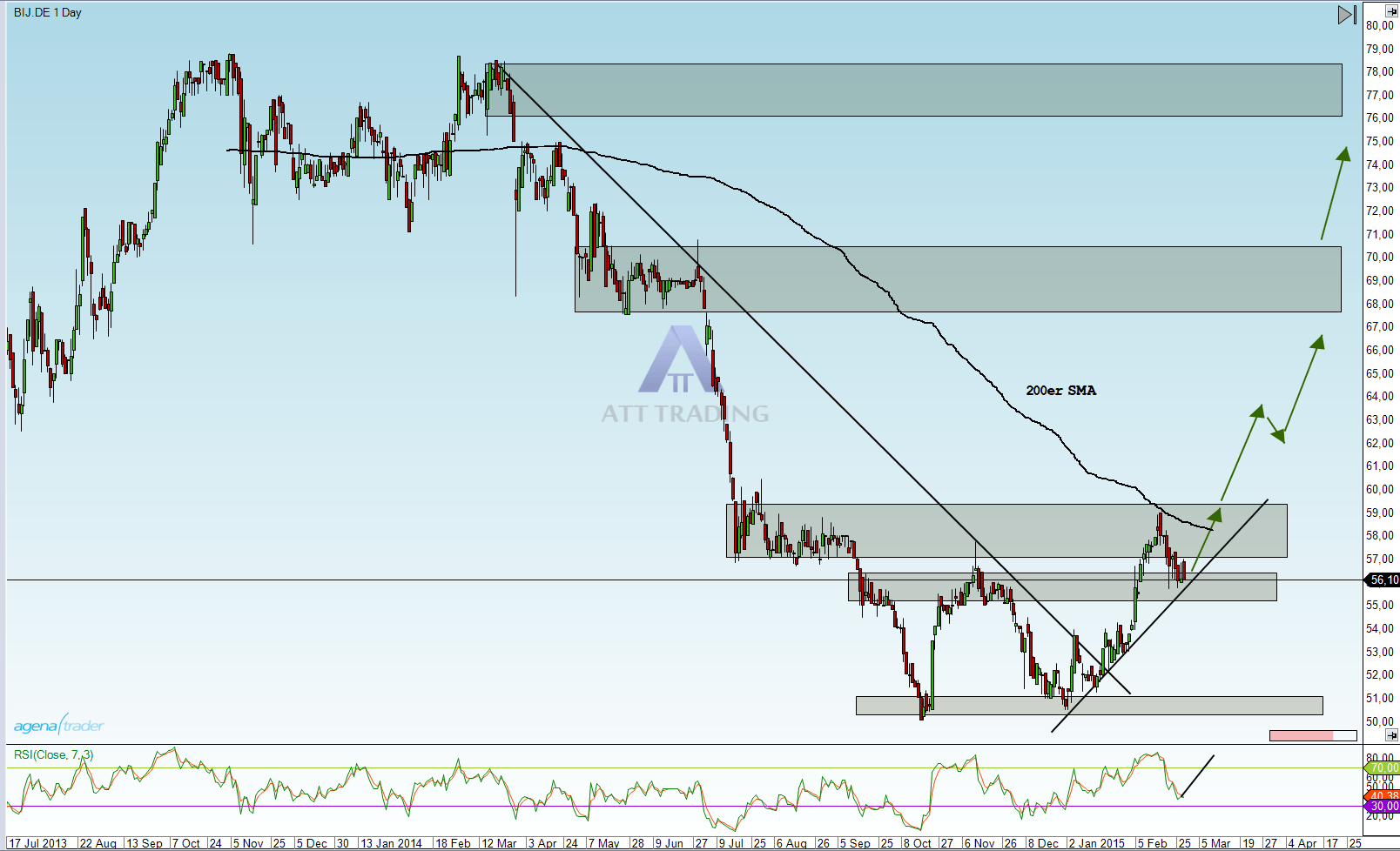

resistance zones: around 57,50€ – 59,00€

support zones: around 55,00€ – 56,00 €

BIJ – Bijou Brigitte modischer Accessoires AG

Bijou Brigitte is a provider of custome jewelry and accessoires. Because of the turn of the season the company is producing 2 jewelry collections for women every year. The product line of the corporation includes high-class jewelry like earrings, watches, scarfs and bags. The company has subsidiaries in China, Poland, Czechia, USA, Lithuania, Bulgaria, Norway and Switzerland.

Current situation and outlook:

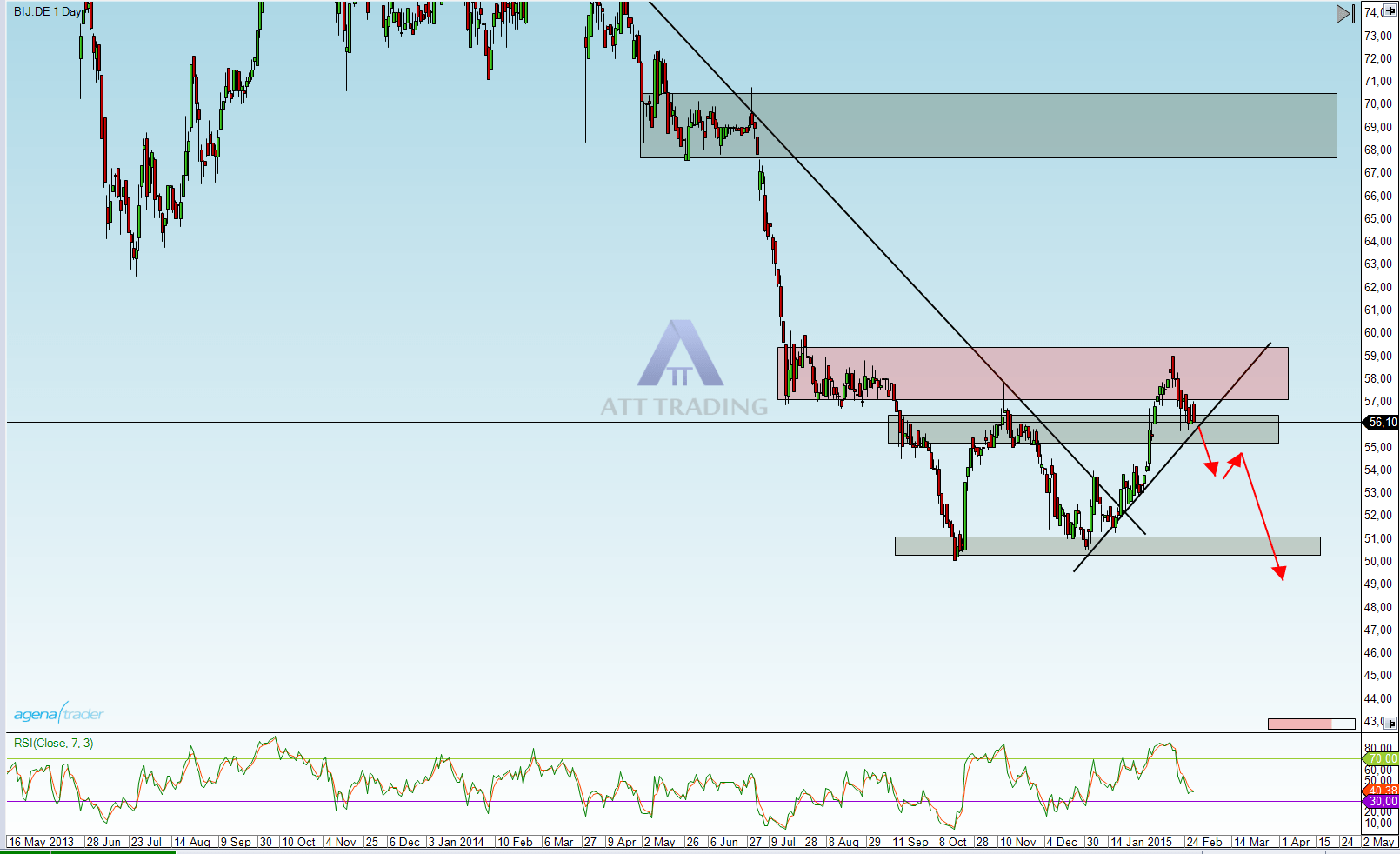

The stock of Bijou Brigitte AG made a clear downtrend to 50€ over the last year. Since october 2014 this downtrend got a little slower and we can already see the first signs of a possible turnaround. At the beginning of 2015 the stock was able to profit from the overall good market condicions and moved up tot he 200 SMA.

Possible scenario:

There is a good chance for stock to move up again, if the price will break through the zone around 56,80€ – 57,00 € and the 200 SMA. After that we can look for a long entry.

Alternativ scenario:

If the stock would go under the trendline and the zone around 55,00 €, the uptrend would not be confirmed and we would not do any long-trades. But we would also not entry an short-positions because the target at 50,00 € would be to close.

Conclusion:

The stock of Bijou Brigitte has right now a lot of potential to move up again. Traders who buy this stock would have lucrative targets around 68,00 € – 70,00 €.

Disclaimer:

Disclosure according to § 34b WpHG due to potential conflicts of interest:

The author is not invested in the relevant securities or underlying securities at the time of publication of this Analysis.