Background and Analysis

Freescale Semiconductor, Ltd. is an American multinational Company which designs and produces Embedded-Processing solutions. In 2006 FSL agreed to a buyout by a consortium led by Blackstone Group. In 2011 FSL completed it´s IPO and is traded on the NYSE since then. In 2012 Freescale Semiconductor was bought by NXP Semiconductors (NXPI).

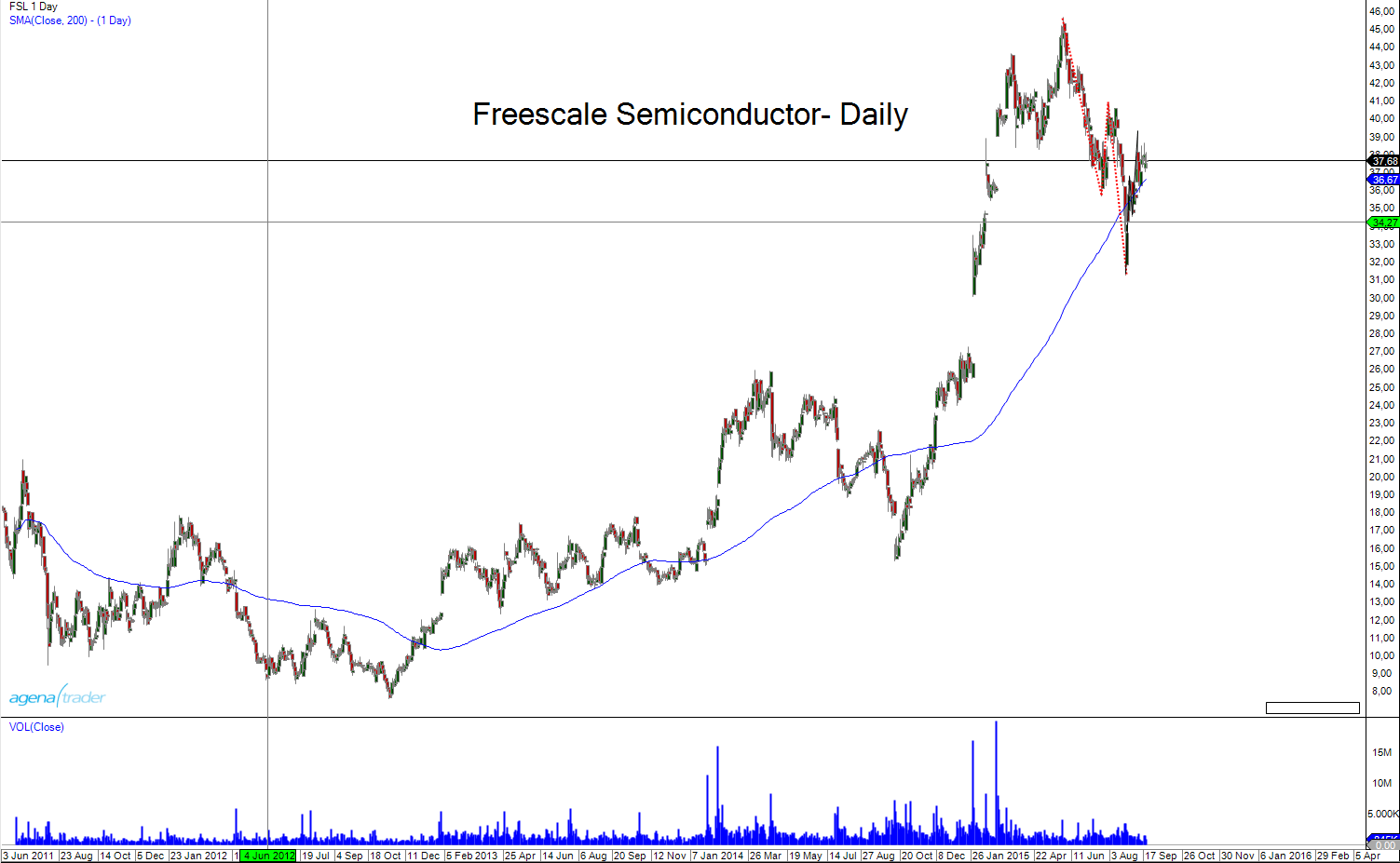

In the following technical analysis we will have a look on the downside-potential of FSL in a weak overall market. As you can see in figure 1, FSL is in a long-term uptrend since 2012, after the weakness in 2014, FSL made new highs in 2015 in a massive uptrend with only very small corrections. FSL developed a new all-time high on 06.01.2015 at $45.69.

Since the high in June Freescale temporarily lost around 30% of its value but in the last few weeks FSL bounced back from the low in August to $37.60 at the moment.

With the yearly high Freescale Semiconductor developed a clearly visible downtrend (figure1 red dotted line).

Trading

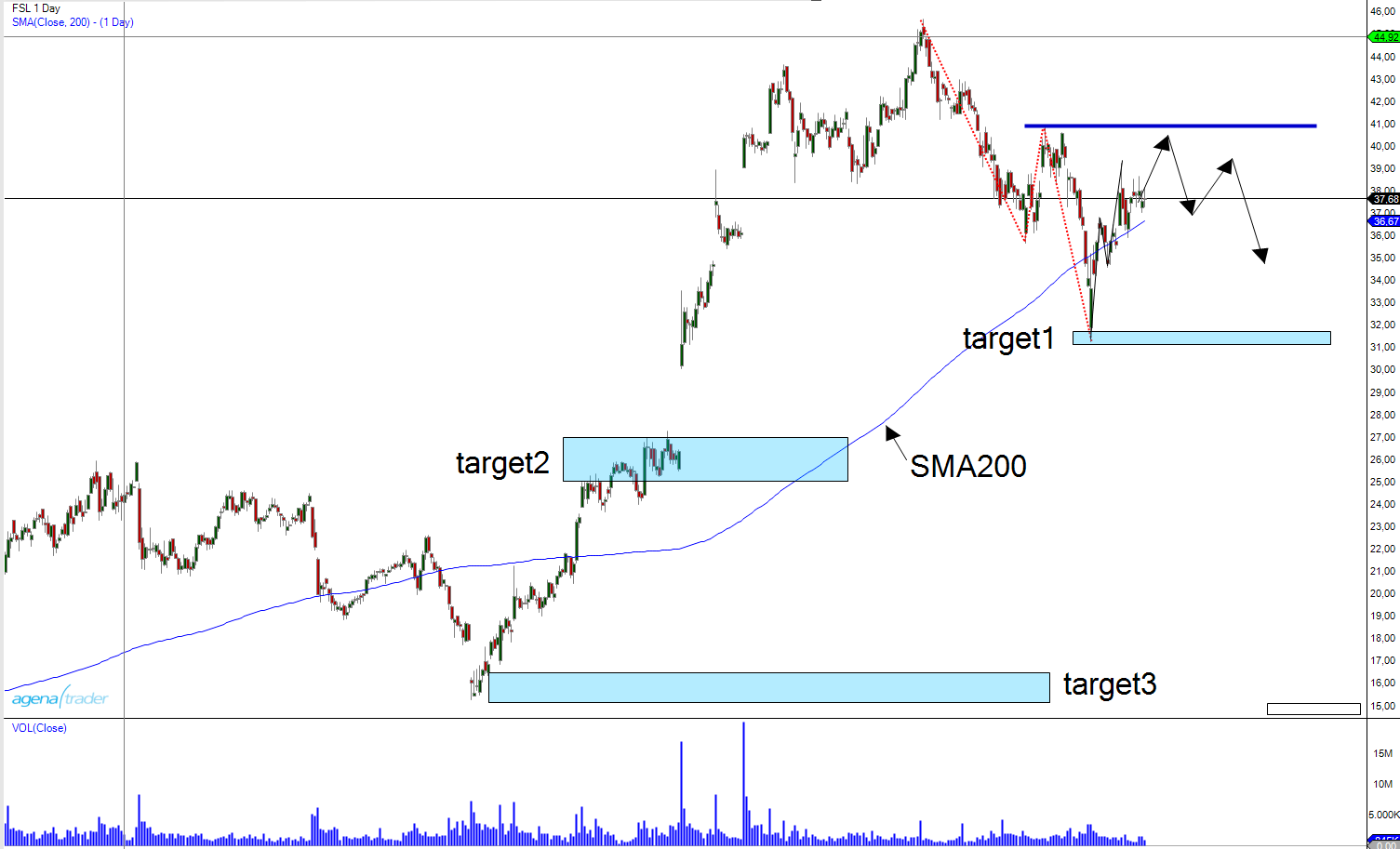

The actual down trend is in a correction which we want to use to enter a short trade. For entering a trade we could use a smaller down trend. The black arrows show one possible development of the stock price. Because of the high correction even our first target (figure2, target1) of $31.50 is quite lucrative, there you should consider a partial take profit. In front of our remaining position there are still interesting targets (figure2, target2) and in a weak total market even target3 might be possible with a small position still in the market after target 1 and 2.

If FSL breaks the blue line (figure2) clearly our short idea is over. If the stock price comes close to the blue line or breaks it only marginally and shows weakness we could still consider to enter a short trade with a really small stop loss.

Before any trade it is always necessary to look for news e.g. company earnings.

Parameters

Entry: $37.90-$39.50 or $40.90

Stop: $41.00.

Targets: $31.50, $25.00 long-term $16.00.

Time-frame: medium-term

Disclaimer:

Disclosure according to § 34b WpHG due to potential conflicts of interest:

The author is not invested in the relevant securities or underlying securities at the time of publication of this analysis