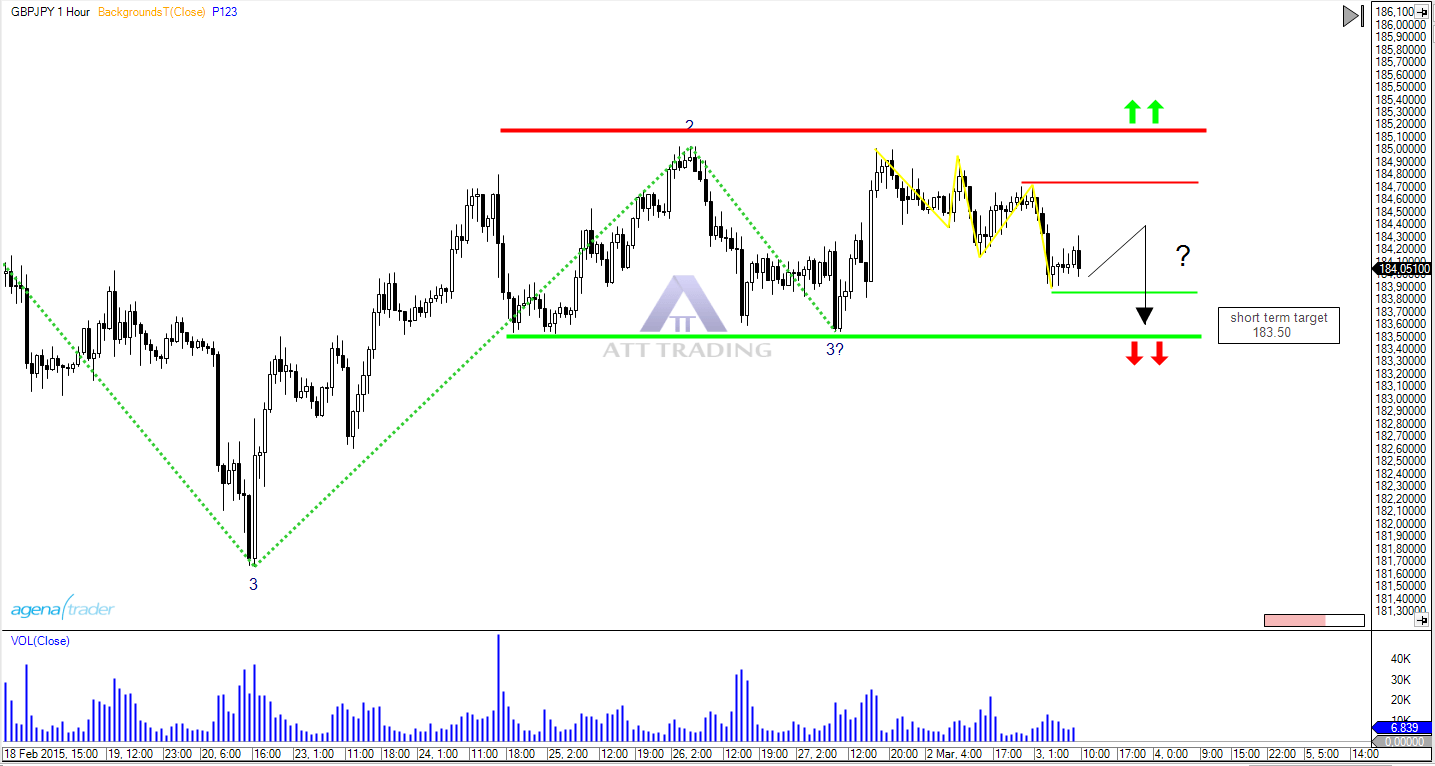

Timeframe:

short-term: hours

hour-chart: figure 1

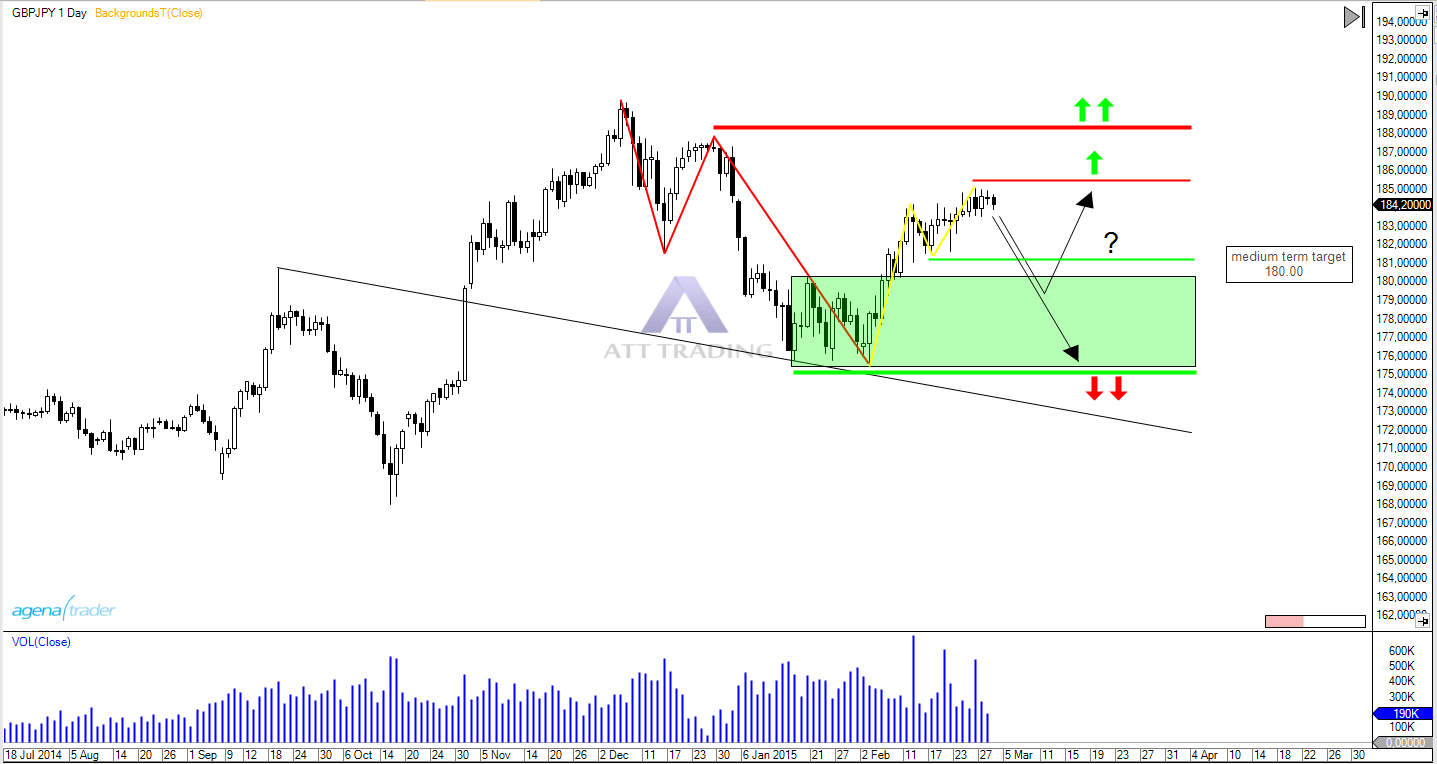

mid-term: days

daily-chart: figure 2

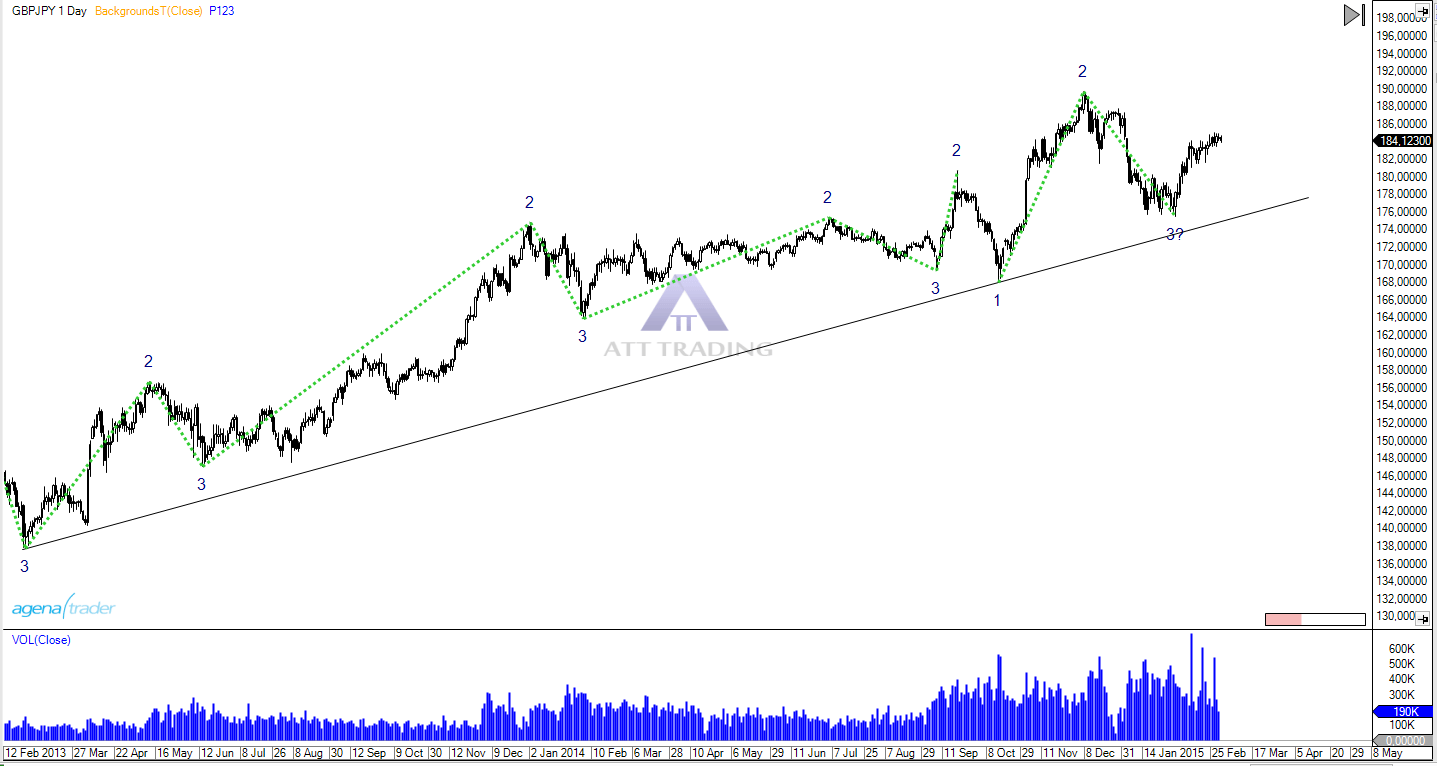

long-term: weeks

daily-chart: figure 3

Tendency:

short-term: down

down until the first target at 183.50

up until 184.70

mid-term: down

down under 183.50 until the first target at 180.00

up above 184.70 until 190.00

long-term: up

down under 180.00 until 175.00

up above 190.00 until 194.00

Current Situation and Outlook:

If we look at the hour-chart of GBP/JPY we will see that the current short-term situation is quit difficult. The price is clearly moving sideways between 183.50 and 184.70.

This sideway phase was built out of an uptrend (figure 1, green trend) which just tested the last high and low, but the price was not able to move above or under these important points.

Right now the price has just made a new downtrend (figure 1, yellow trend) and is on it´s way to test the last low at 183.50.

If we look at the daily-chart we will notice a bigger downtrend (figure 2, red trend) which just made a large correction. Whereby this correction is also a small uptrend (figure 2, yellow trend).

Corrections have the characteristic of moving quit slow and weak and we can see this here very clearly. Especially over the last 2 weeks the GBP/JPY is already showing some weakness as we can see more and more inside candles. A short entry would be possible if the price would make a clear downtrend with a target at 180.00. But because of the large green supoort line it is doubtful if the price will go below this level.

If we look at the longer-term daily-chart we see a clear uptrend which made a correction of about 70% of the last up movement. It is neccessary to look at the short- and mid-term situation, because the current up movement is quit weak and slow.

pro short:

– midterm downtrend

– weak up movement

– high volume with falling prices

contra short:

– longterm uptrend

Conclusion:

The GBP/JPY made a longterm uptrend, which is now at a difficult situation where the price has to decide if the longterm uptrend will continue or if we will see lower prices. Right now we see more arguments for falling prices, because the midterm downtrend made a correction and is already showing some weakness. If the price will go down it is very important to look at the support level at 180.00 (figure 2, green box).

At this level we can see 2 possible scenarios: The GBP/JPY will fall to or even under the level of 175.00 or the price will continue it´s longterm uptrend.

Last it is also very important to look at the decisions of both central banks because monetary decisions can have a huge impact on the price.

Disclaimer:

Disclosure according to § 34b WpHG due to potential conflicts of interest:

The author is not invested in the relevant securities or underlying securities at the time of publication of this Analysis.