Timeframe:

short-term: hours

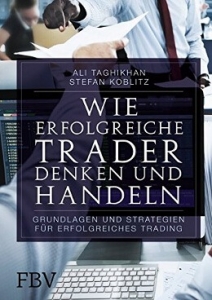

1-hour-chart (figure 1)

mid-term: days

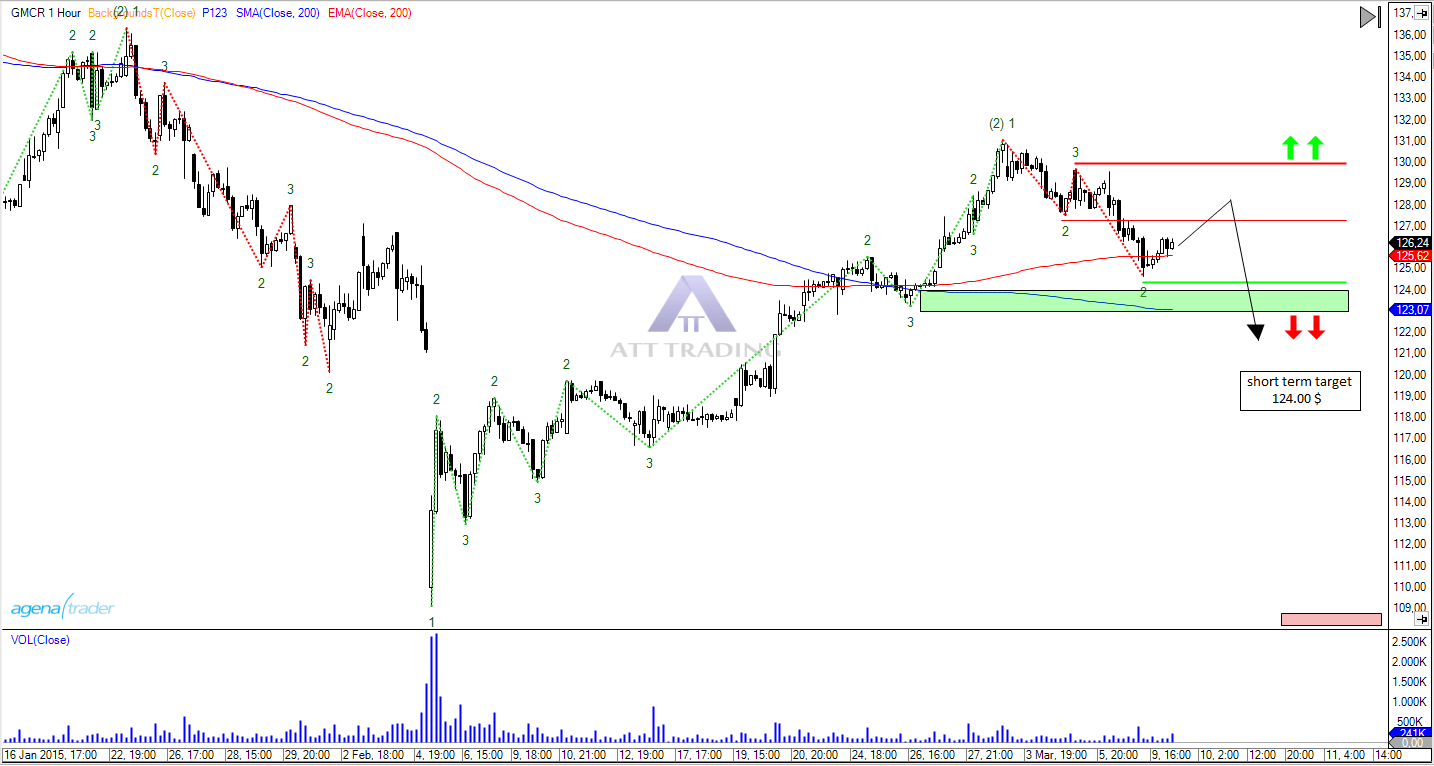

daily-chart (figure 2)

long-term: weeks

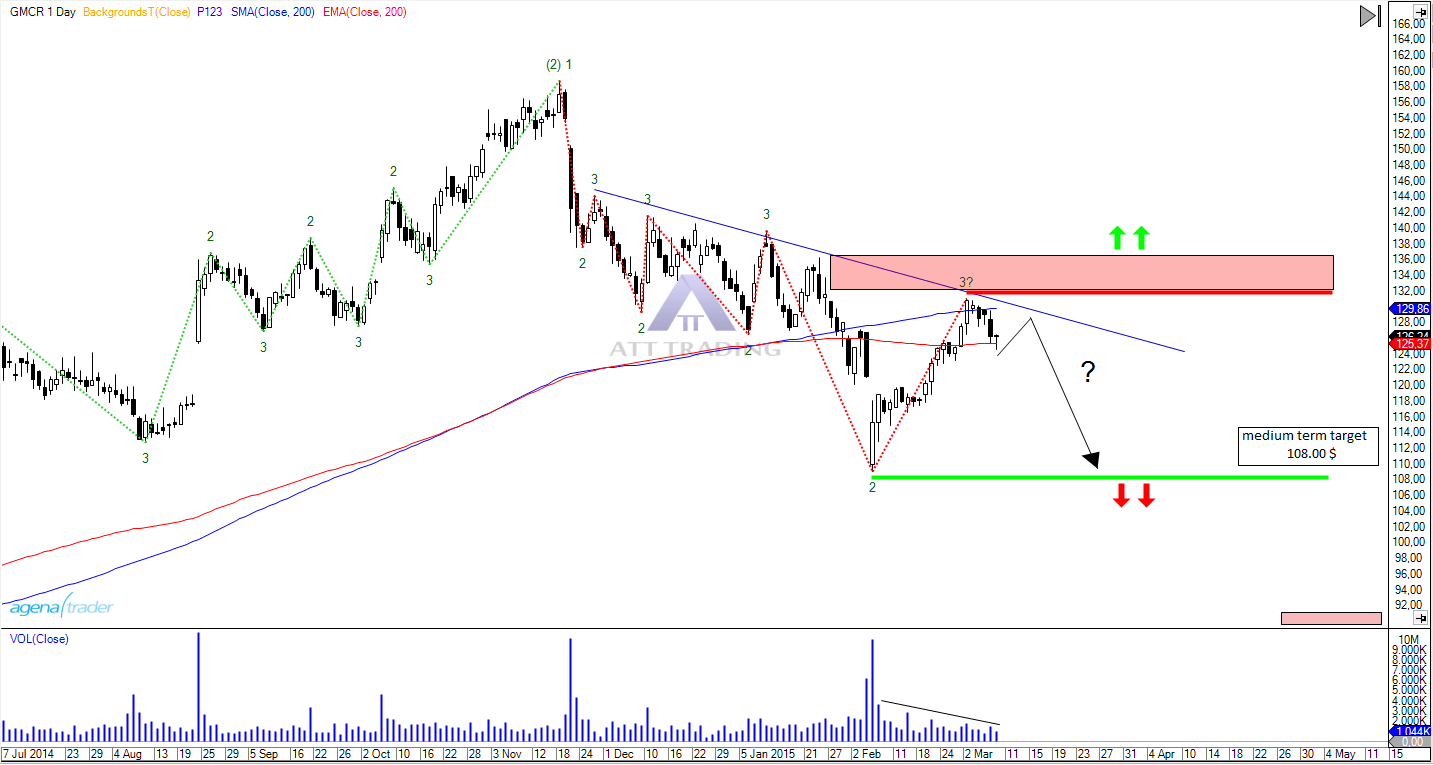

daily-chart (figure 3)

Tendency:

short-term: down

down until the first target at $123,00

up above $130,00 until the first target at $132,00

mid-term: down

down under $124,00 until the first target at $108,00

up above $132,00 until the first target at $160,00

long-term: up

down under $108 until the first target at $90,00

up above $160,00 until the first target at $170,00

Current situation and outlook:

Keurig Green Mountain Inc. is one of the biggest companies in the coffee industry worldwide. The main business of the company is trading with coffee and tea, and also the production of coffee machines. In addition to that the corporation has made some innovative and award winning technology in the coffee and tea industry.

We we look at the stock on a short-term horizon, we can cleary see an upward trend (figure 1, green trend). This trend is still intact right now, but we can also see a counter signal on the same trend size (figure 1, red trend). And because of that we expect falling prices to the first target at $124,00. But the current down-trend would only be broken above the area around $130,00 and that means the correction can continue a little bit.

If the price would go under the price level around $124,00 the short uptrend would be over and the mid-term target would be at $108,00. This target is the last low point of the downtrend on the daily-chart (figure 2, red trend). This down-movement made a 80% correction right now. The stock has now arrived at the SMA 200 and is already showing some weakness. When we talk about trend following, we always have to look at the volume and right here we can see higher volume when the stock is going down.

This short scenario would be over if the price would go above $132,00.

The long-term picture of GMCR shows a major uptrend (figure 3, green trend), which is now in a correction. But the stock has just bounced right on the blue trend line (figure 3) and is showing some strenght, and because of that the stock is still up, but it would be a major counter signal if the price would go under the $108,00.

pro short:

– short- and mid-term downtrend

– higher volume with falling prices

– weakness at 200 SMA

– long-term downtrend at coffee

contra short:

– long-term uptrend

– large correction

Right now is seems like the stock would continue it´s short- and mid-term downtrend. If this is going to happen we might see also falling prices at the long-term horizon. Nevertheless we also always have to look at the overall market. The company is very much depending on the coffee price and right now coffee has made a major downtrend and this trend might continue if the US-dollar is getting stronger.

Disclaimer: Disclosure according to § 34b WpHG due to potential conflicts of interest:

The author is invested in the relevant securities or underlying securities at the time of publication of this Analysis.