Daimler could follow the weak overall market

Background Daimler AG (DAI) is a leading international car producer which builds passenger cars, commercial vehicles and offers financial services. The company offers its vehicles and services in nearly all countries around the globe. The stock made an uptrend over the last 5 year, but made currently a strong correction which is a downtrend on […]

Newell is set to fall

Background Newell Rubbermaid is a company that operates in the consumer goods sector. The company works with Global Business Units, which develop world brands. Newell Rubbermaid has a wide range of products. In Figure 1 we can see that the stock price has risen since 2011 from $12.00 to $44.00. The stock made a stable […]

Freescale is set to drop with weak overall market

Background and Analysis Freescale Semiconductor, Ltd. is an American multinational Company which designs and produces Embedded-Processing solutions. In 2006 FSL agreed to a buyout by a consortium led by Blackstone Group. In 2011 FSL completed it´s IPO and is traded on the NYSE since then. In 2012 Freescale Semiconductor was bought by NXP Semiconductors (NXPI). […]

Adidas AG – Fundamental Analysis

Adidas AG Adidas is a German sports equipment manufacturer and was founded in 1949. The company has it´s headquarter in Herzogenaurach and has currently about 53.700 employees. Since 1995 Adidas is listed in the DAX on the Frankfurt Stock Exchange and currently the corporation has a market capitalization of 14,7 billion euros. With […]

Google Inc. (GOOG)

Timeframe: short- mid-term Overview: Google is one of the most famous brands in the world and one of the leading global technology company. Beside the well-known search website, the corporation also offers other products or services such as the email service Gmail, the social networking platform Google+ and the Google Chrome […]

ZIONS Bancorporation

Timeframe: short-, mid-term Overview: Zions Bancorp. is a US corporation that operates in the banking business. The activities of the financial group includes the traditional banking services for private and corporate clients e.g. loans for companies, real estate morgages and investment products. Since march 2014 the daily chart shows us a long-term downtrend which […]

Keurig Green Mountain

Timeframe: short-term: hours 1-hour-chart (figure 1) mid-term: days daily-chart (figure 2) long-term: weeks daily-chart (figure 3) Tendency: short-term: down down until the first target at $123,00 up above $130,00 until the first target at $132,00 mid-term: down down under $124,00 until the first target at $108,00 up above $132,00 until […]

Chart-analysis Bilfinger (GBF) – Can the stock continue it´s run?

Timeframe: short-, medium-term Tendency: short-term: up medium-term: up resistance zones: around 55,50 € – 55,00 € support zones: around 52,90 € – 53,50 € Bilfinger (GBF) Bilfinger SE is an international corporation, which is involved in all areas of construction. The company provides services related to maintenance of industrial plants […]

Apple – Fundamental Analysis

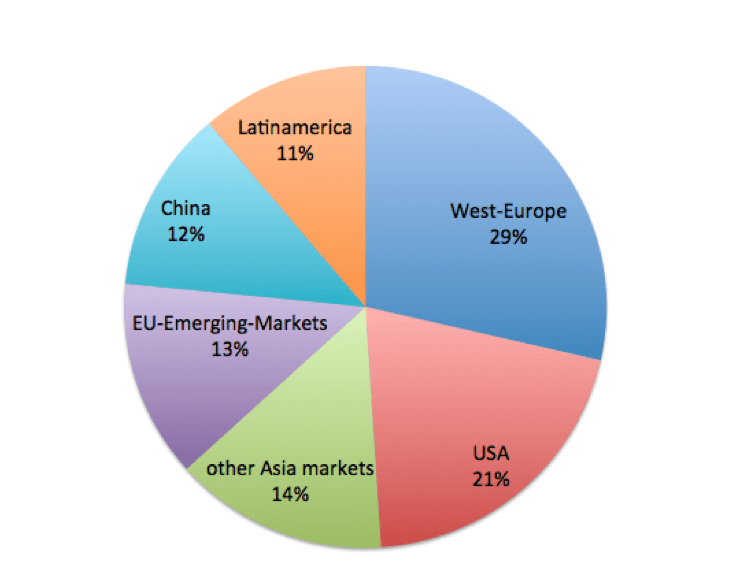

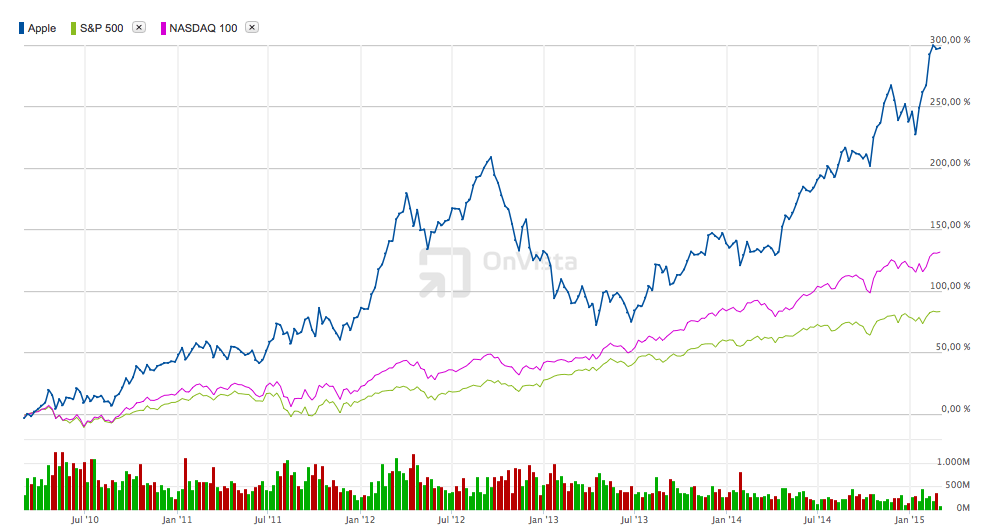

Apple Inc. Apple Inc. is an American technology company with headquarters in Cupertino, California, and was founded in 1976 by Steve Jobs, Steve Wozniak and Ronald Wayne. The company manufactures computers, smartphones, tablets and consumer electronics, while providing operating systems and application software. The corporation currently has approximately 93,000 employees and sells products […]

Marsh & McLennan Comp.

Chart Technical Analysis of Marsh & McLennan Comp. Share, based on the daily Chart. Over the medium term, the shares of MMC are in an intact downtrend (figure 1, shown in red).The last downward movement has now almost fully corrected. The correction in the subordinate time frame, on a smaller trend size trend, has established […]